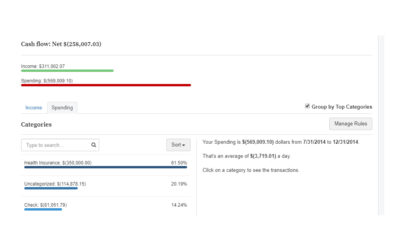

Wealth Access “Intelligent Aggregation” provides an end-to-end, customizable solution for institutions to enable their advisors to enhance the digital client experience. Wealth Access, the industry’s largest independent personal financial management and account...