Connect Your Data.

See As One.

Wealth Access is the intelligence layer that unifies your data across every line of business—so your financial institution can unlock growth and operate as one.

Powering Connected Intelligence at 60+ Institutions

Data

Connects

Here

Your data already holds the answers. The problem is it's scattered and siloed. We connect it all into a single intelligent layer your organization can act and build on.

Unify fragmented data into one intelligent layer so advisors, bankers, and clients all work from the same complete picture.

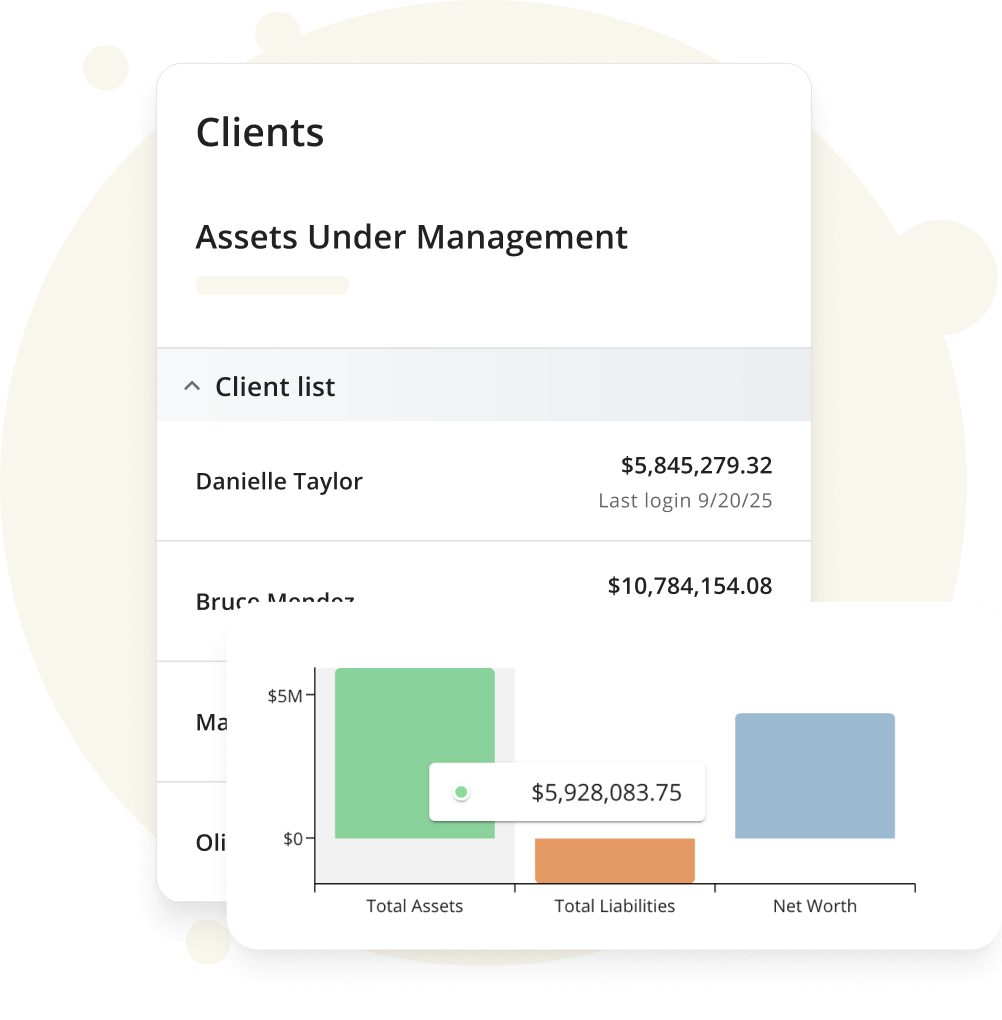

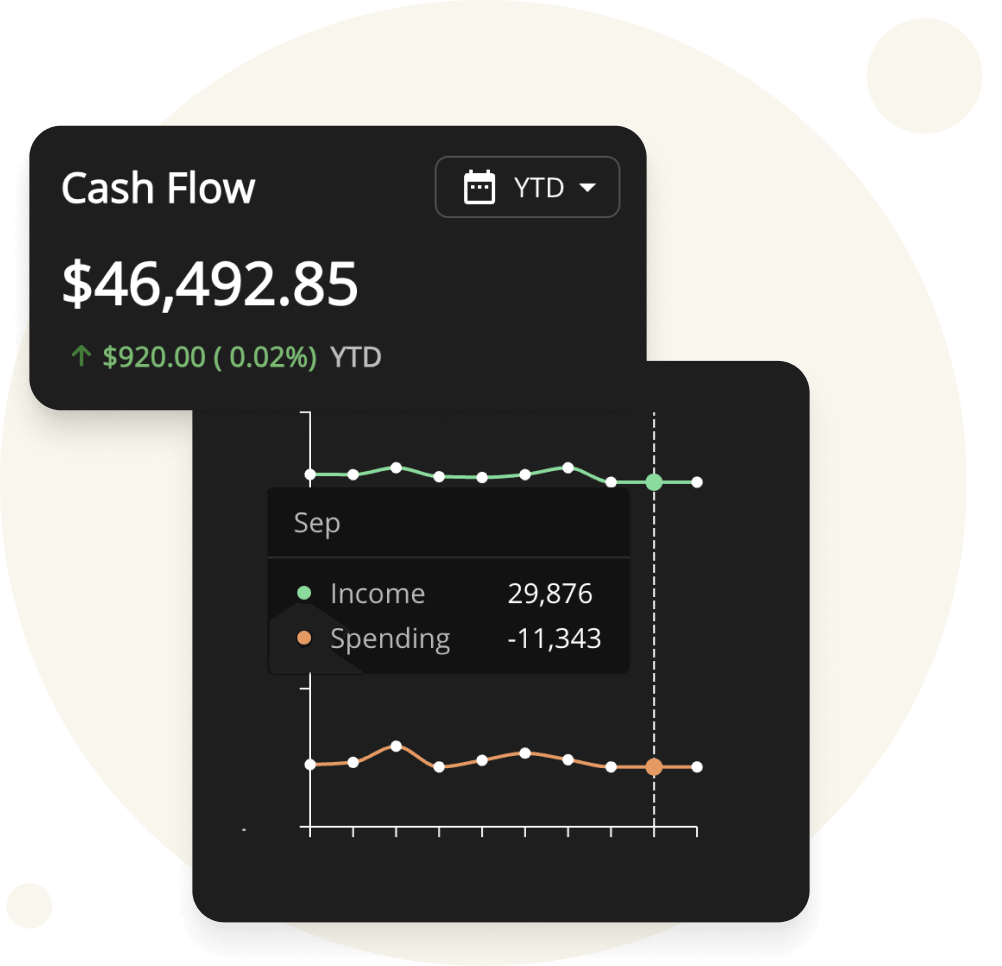

A unified, secure view of each client's full financial picture—including held-away assets—with role-based access.

Scalable and compliant AI initiatives require clean, unified, and permissioned data—Wealth Access delivers exactly this.

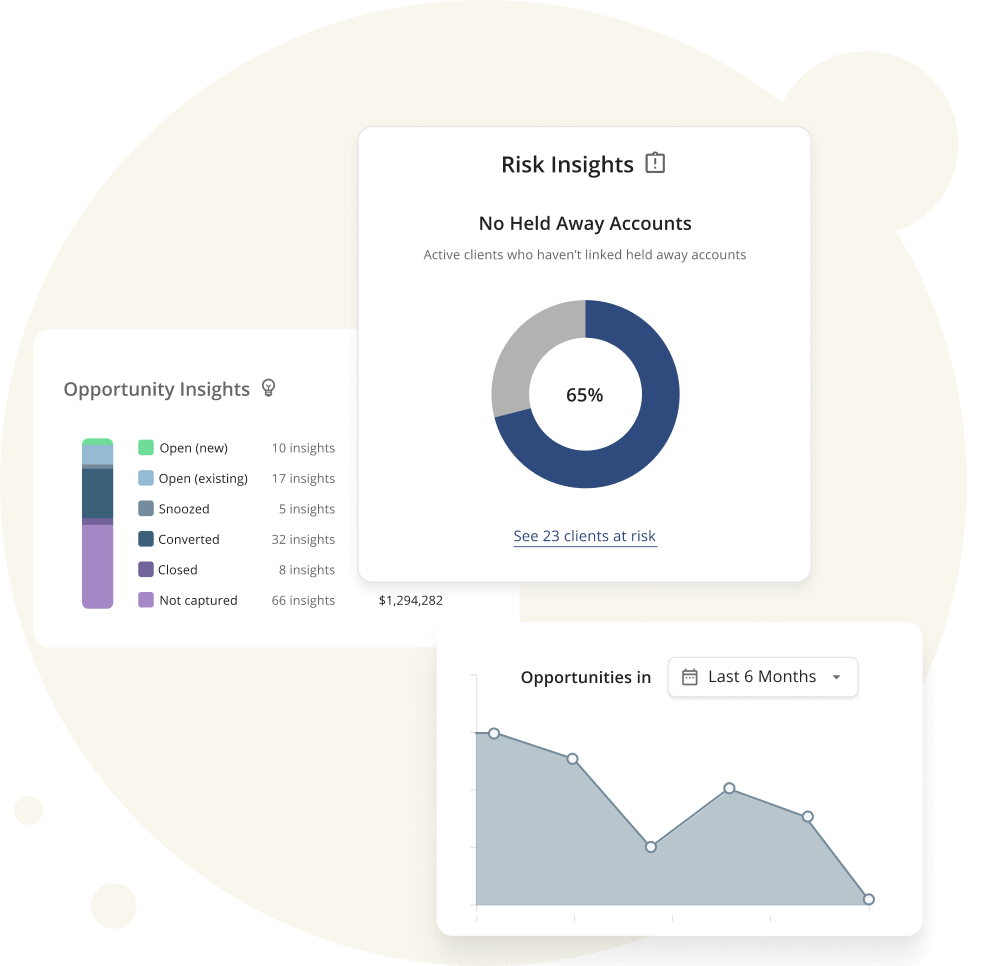

Armed with intelligent data, your team can deliver bespoke experiences that attract new assets and grow revenue.

A unified data layer becomes the launchpad for every digital initiative, from AI to client experience modernization.

The roadblocks holding most financial institutions back aren't about talent or ambition; they're almost always rooted in disconnected data.

Fragmented data creates fragmented experiences—and pushes clients toward competitors who feel more connected.

When teams can't see the full picture, they miss cross-sell opportunities and fail to surface held-away assets.

Without clean, unified data, your technology roadmap stays stuck in neutral—and the market pulls ahead.

THREE PILLARS.

PURPOSE-BUILT.

The Wealth Access platform integrates with your existing cores, custodians, and tools—creating a single, governed data layer through our proprietary UETL framework. Fast to deploy, built for growth, and AI-ready from the ground up.

Extract, organize, and enrich data from legacy cores using our open API architecture—creating unified intelligence at the client and household level.

Enjoy role-based, configurable dashboards that give your stakeholders a holistic picture of client assets, down to the penny.

Aggregate and enrich data from across your institution and your clients' financial lives, powering insights that drive smarter decisions.

“Many solutions in fintech only offered a piece of the pie, but they couldn’t take it all the way through into our mainframes. When I looked at Wealth Access, it had the ability to really bring it straight through for me and stretch it across multiple platforms.”

"Data is king, and Wealth Access has given us access to all of our data in one place — something we’ve never had before. Now, we’re not just delivering digital experiences; we’re showing personal and business banking clients how we can add value through our wealth services."

“Wealth Access has become indispensable to the Fulton client experience. It allows us to give a high-touch, highly personal feel for the information clients find most valuable.”

DEPLOY

WITH

CONFIDENCE

Our clients live in weeks, not quarters—no heavy conversion, no endless IT cycles, just faster time-to-value. We currently integrate with 25+ core providers and custodians.

No

More

Silos

When every team operates with unified data, the benefits go beyond cross-selling between wealth and retail—you build a robust and agile foundation for the future.

DISCOVER WEALTH ACCESS

Join the 60+ institutions that have transformed fragmented data into connected intelligence. Schedule a demo and let's explore what's possible.

Questions?

Who is Wealth Access?

We are a Connected Intelligence Platform serving U.S. community and regional banks as well as wealth management firms. We act as the foundational layer that unifies fragmented data from banking, trust, brokerage, and retirement systems. By creating a single source of truth, we help institutions deliver personalized client experiences and prepare for AI-driven engagement without replacing their core legacy systems.

How does the technology integrate with existing systems?

We use a proprietary Universal Extract, Transform, Load (UETL) framework and an API-first architecture. Instead of a high-risk core conversion, Wealth Access overlays on your existing systems to ingest, enrich, and normalize data in real time. This low-friction approach enables faster implementation and deployment compared to traditional competitors, delivering ROI and time-to-value more quickly.

How does Wealth Access support AI-readiness?

Meaningful AI requires a foundation of unified, clean, and permissioned data—something most banks currently lack. Wealth Access provides this foundation by organizing siloed data into an AI-ready layer. Our ongoing product roadmap will continue making AI initiatives explainable, compliant, and scalable across the institution. We deploy AI-related features only to drive productivity, never for the sake of hype or flashy demos.

Is the “Intelligence Layer” available to retail clients?

No. Our intelligence features are designed specifically for your financial institution’s stakeholders, not direct-to-consumer use. This stance ensures the platform empowers professional relationships rather than replacing them. It also prevents a second voice from potentially contradicting the firm’s specific recommendations or fee structures.

How does the platform impact advisor productivity?

The platform automates the most tedious parts of an advisor's job, such as manual data entry from private equity statements or aggregating data for quarterly reviews. By surfacing insights—such as which clients have significant "money in motion" or who hasn't logged in—advisors can prioritize their outreach based on data rather than guesswork. This allows them to spend more time on high-value client relationships and prospecting.